Intelligent TV and Display

It is estimated that the global TV panel shipments will remain at 261 million units in 2018, but the rapid growth of demand for large-size panel market will drive the average size increase of 1.7 inches, which will drive the panel demand area to increase by 7.6%. At the same time, the whole machine manufacturer also actively planned the layout of large-size products in 2018. The average size of the global TV machine increased to 44.8 inches, an increase of 1.5 size.

From a technical point of view, relative to the mobile terminal market, the technological innovation in the TV market has been quite small in recent years. Qunzhi Consulting believes that the technology of the TV market in 2018 is still based on the "quality and appearance" as a main axis, showing a diversified trend, 4K accelerating popularity, 8K ushered in development opportunities, quantum dots, borderless and large-size products will welcome Come to grow quickly.

First, the picture quality

1. Resolution: Open 8K year

Whether it is LCD or OLED display, improving image quality has always been the core focus of display product development. TV products have improved the picture quality through various means, especially the continuous improvement of resolution, and have experienced the popularity from HD to FHD to 4K. According to Qunzhi Consulting data, in 2017, the global shipment of 4K LCD TV panels reached 92 million, and the penetration rate increased to 35.3%. By 2018, the global shipment of 4K LCD TV panels is expected to reach 116 million, and the penetration rate will increase to 44.5%. In the large-size LCD panel market of 55" and above, the penetration rate of 4K panels has exceeded 90%. In the future, the penetration rate of 4K panels in the middle section of 43"~50" still has a large room for improvement.

4K is gradually becoming fully popular in the medium and large size market, and 8K will be the next battleground for panel makers. It is subject to human eye identifiability. 8K products are mainly concentrated in the large size market of 65" and above.

Sigmaintell expects that the first year of development of 8K TV will be launched in 2018, and it is expected to accelerate penetration after 2019. It is expected that the shipment of 8K panels will reach 9 million units in 2022, and the penetration rate will increase to 3.5. %. Mainly based on the following five reasons:

First, the 8K Soc solution in 2018 will gradually achieve mass production, enabling the TV machine to achieve a true 8K.

Second, more and more G10.5 will usher in mass production, providing basic capacity guarantee for large-size panels of 65" and above. With the large size, it will also drive 8K shipment growth.

Third, the whole machine factory is also actively planning and layout. The Sharp brand has released its 8K products in 2017, and Samsung Electronics will also promote 8K in 2018.

Fourth, the 8K content will be accelerated. The 8K content will be broadcast live in the 2020 Tokyo Olympic Games. The 8K content will be broadcast live in the 2022 Beijing Winter Games. The adoption of international events will accelerate the distribution of 8K content in various regions of the world.

Fifth, mobile operators in China and other regions are actively planning 5G network commercialization, which is more powerful in supporting the transmission and operation of 8K content.

2. QD TV continues to grow at a high speed

On the one hand, the traditional QD backlight module replaces the diffuser sheet in the original TV backlight with a quantum dot film (QD Film), which greatly increases the display color gamut of the TV to more than 100%, which greatly compensates for the LED backlight in the color gamut. Natural deficiency. With the efforts of the upstream and downstream of the TV industry, the monopoly of OQ film materials has been broken, more and more domestic manufacturers have joined, and the work on cost reduction has begun to bear fruit. According to Sigmaintell, SigmaIntellect expects 20D Film prices will drop by about 20%; on the other hand, in 2018, Samsung (SDC) will actively launch new QD products, including QD Glass and QD Pixel, among which QD Glass is about to usher in mass production, QD Glass design, manufacturers put The quantum dot material is directly coated on the LGP to achieve a perfect image quality, and an ultra-thin design can be realized. Under the premise that the cost has not increased significantly, brand manufacturers will be more diversified in the choice of QD products.

In addition to panel manufacturers continue to promote technological innovation and rich resources, the whole machine side has gradually formed a Samsung-based camp, Chinese brands TCL and Hisense also actively deployed QD TV. Since 2017, Samsung Electronics has been promoting QD TV in the high-end product market. In 2018, QD TV is also the top priority of its product layout. The active promotion of mainstream manufacturers has led to a rapid growth in the shipment scale and penetration rate of QD TV. According to Sigmaintell data, the number of QD TV shipments in the world reached 7.3 million units in 2017, almost double the number in 2016. It is expected that with the active promotion of the brand's active strategy in 2018, the shipment of global QD TV will continue to grow at a high speed. The shipment volume is expected to reach 14.3 million units and the penetration rate will increase to 6%.

Second, the appearance: the pursuit of the ultimate "-thin-narrow-large"

1. Brand strategy changes, curved TV panel shipments decline

Since the launch of the curved TV, due to its unique appearance, it has received a lot of attention from the market and has been favored by some consumers, especially in the Chinese market. However, after several years of sales of curved TV, the penetration rate has not increased significantly, especially in overseas markets. However, since 2017, brand manufacturers led by Samsung Electronics have gradually turned conservative to curved TV strategies. In 2018, each brand factory continued to focus on some of the old product lines. The planning of new product lines was less, and the layout of curved TVs was more conservative. In addition to TCL, other Chinese manufacturers have gradually become more conservative in the planning of curved surfaces.

In 2017, the panel factory continued to promote process changes such as COA and BCS, and the quality of curved panels was effectively improved. From the perspective of product layout, the curved panel is mainly concentrated in the medium and large size products of 48" or more, and the high-end products are configured with HDR, WCG, ultra-thin and no border. From the perspective of curvature, the panel factory is 55" and 65". In the mainstream large size, the full application of 3000R curvature will be realized. In 2018, mainstream panel manufacturers will expand the open cell shared by Pingqu, reducing the risk of brand strategy change and demand decline.

Sigmaintell expects that due to the conservative mainstream brand strategy in 2018, the global surface TV panel shipments will be 9 million units, down 9.7% year-on-year, with a penetration rate of 3.4%, in large-size panels above 48". The penetration rate has been adjusted to 8.1%. The market for curved TV will maintain a steady decline in the next few years.

2. Three sides without borders are expected to become mainstream products

In the processing of the frame, manufacturers are constantly pursuing the ultimate, the TV frame from the narrow border to the borderless evolution, bringing consumers a stylish aesthetic. Panel manufacturers are also actively cooperating with the market demand for borderless TVs. Manufacturers need GOA process, R angle design, and Side sealing at the edge without a frame when producing a frameless panel. At present, major panel manufacturers are continuing to expand the production capacity of GOA and improve product yield, resulting in a reduction in borderless cost and improved supply capacity. It is expected that by 2018, brand manufacturers will not only limit the three-sided products to high-end products. The production of four-sided borderless products still faces the technical challenge of module segment FPC Bonding. The production cost and difficulty coefficient are relatively high. Currently, Korean factories are the dominant ones, but more manufacturers will start to actively deploy in 2018.

3. Large size products will burst into growth

At present, the TV market is mainly based on the demand for replacement. With the opening of the global TV panel high generation line, the market is becoming more and more large-scale, and consumers are becoming more and more aware of the large size.

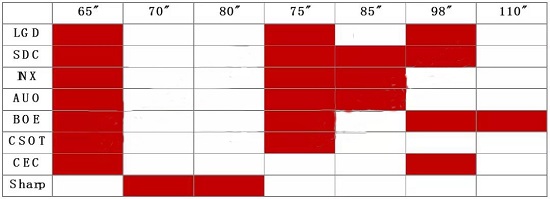

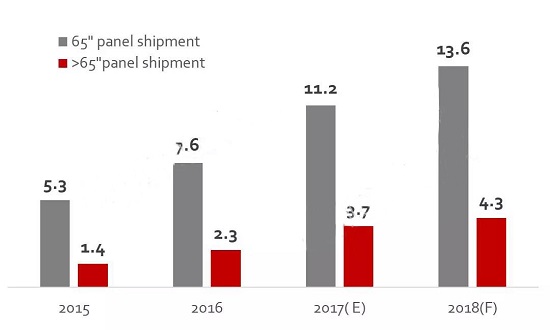

In 2018, Hantai manufacturers increased the production capacity of large-size panels of 65" and above on the basis of existing production lines. On the other hand, the G10.5 high-generation panel production line began mass production and supply, and greatly increased the size of 65" and above. The supply capacity of the panel. At the same time, the price of TV panels in the second half of 2017 maintained a downward trend, and the adjustment of prices actively stimulated the growth of demand for large-size panels. According to Sigmaintell data, the 65" panel demand will reach 13.6 million units in 2018, a substantial increase of 22% year-on-year, accounting for more than 5% of the global TV panel market. The oversized size of 65" or more will reach 430. Wantai, a year-on-year increase of 14%, the market share increased to 1.6%.

Third, OLED TV: steady growth

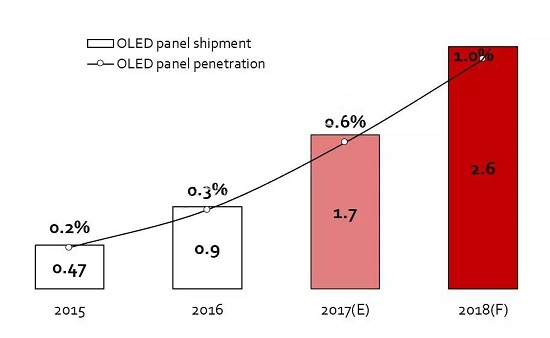

OLED TV is a hot topic in the industry, but the upstream OLED TV panel is still only available exclusively for LMD, and the restrictions imposed by the supply side are very obvious. According to statistics from Sigmaintell, in 2017, thanks to the expansion of LGD capacity and the increase in yield, the number of OLED TV panels shipped reached 1.7 million units, and the penetration rate increased to 0.6%. Although there is no obvious capacity growth in 2018, the yield and efficiency are expected to increase to 2.6 million units, and the penetration rate continues to grow.

LGD is relatively active in the subsequent large-capacity OLED panel capacity planning. The G8.5 generation OLED production line invested in China has been approved by the Korean government. It will start mass production in 2019, and will follow the investment G10.5 generation OLED production line. Planning. Sigmaintell expects the global OLED TV market to grow steadily over the next five years.

Although the TV technology update has entered a stable period, with the development of the Internet of Things, the TV application function is more diversified. In addition to the picture quality and appearance, Sigmaintell believes that in sound quality, intelligent operation, and other smart devices. Interconnection and other aspects have also become particularly important. The competition of TV manufacturers is not limited to brands. It should expand its horizons to compete with other smart devices, and win more users and seize the user's stickiness in the future to become an IOT terminal, and create a full range of product competitiveness.

發送反饋

歷史記錄